Small Business Health Insurance: Plans That Work Globally sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve deeper into the intricacies of small business health insurance on a global scale, the complexities and nuances of providing adequate coverage become apparent.

Understanding Small Business Health Insurance

Small business health insurance is a crucial benefit that employers can provide to their employees, ensuring access to medical care and promoting overall well-being. It plays a significant role in attracting and retaining top talent, as well as maintaining a healthy and productive workforce.

Key Elements of a Good Health Insurance Plan for Small Businesses

- Comprehensive Coverage: A good health insurance plan should cover a wide range of medical services, including preventive care, emergency treatment, and prescription medications.

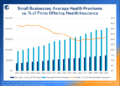

- Affordability: The cost of premiums should be reasonable for both the employer and employees, balancing coverage with financial feasibility.

- Network of Providers: Access to a network of healthcare providers, hospitals, and specialists ensures that employees can receive quality care without facing excessive out-of-pocket costs.

- Wellness Programs: Some health insurance plans offer wellness initiatives to promote healthy lifestyles and prevent chronic diseases, reducing healthcare expenses in the long run.

Challenges Small Businesses Face When Providing Health Insurance Globally

Small businesses often encounter obstacles when offering health insurance benefits on a global scale, including:

- Regulatory Compliance: Navigating different healthcare regulations and requirements in various countries can be complex and time-consuming for small businesses.

- Cultural Differences: Understanding cultural norms and preferences related to healthcare can impact the design and implementation of health insurance plans in different regions.

- Cost Considerations: Healthcare costs vary widely across countries, posing a challenge for small businesses to provide adequate coverage while managing expenses effectively.

Types of Health Insurance Plans for Small Businesses

When it comes to providing health insurance for small businesses, there are several options to consider. Each type of plan has its own set of advantages and disadvantages, so it's important to choose the one that best fits the needs of both the employer and the employees.Group Health Insurance:Group health insurance is a common choice for small businesses because it covers all eligible employees under one policy.

This type of plan typically offers lower premiums and better coverage than individual plans. By pooling employees together, small businesses can often negotiate better rates with insurance providers. However, group health insurance may limit employees' choices in terms of coverage options and healthcare providers.Individual Health Plans:Individual health plans allow employees to choose their own insurance coverage independently of their employer.

While this gives employees more flexibility and control over their healthcare options, individual plans can be more expensive than group plans. Small businesses may offer stipends or reimbursements to help employees cover the cost of individual plans. However, this approach may lack the bargaining power and cost-effectiveness of group plans.

Examples of Successful Health Insurance Plans for Small Businesses

- Company A, a small tech startup, offers a group health insurance plan that includes coverage for mental health services and wellness programs. This comprehensive approach has helped attract and retain top talent in a competitive industry.

- Restaurant B provides individual health plan stipends to employees, allowing them to choose the coverage that best fits their needs. This flexibility has improved employee satisfaction and loyalty within the company.

Advantages and Disadvantages of Group Health Insurance vs. Individual Health Plans

| Group Health Insurance | Individual Health Plans |

|---|---|

| Advantages: | Advantages: |

|

|

| Disadvantages: | Disadvantages: |

|

|

Global Considerations for Small Business Health Insurance

When it comes to choosing a health insurance plan that works globally, small businesses need to take into account several key factors. The impact of varying healthcare systems and regulations, as well as cultural differences, can greatly influence the effectiveness of health insurance benefits offered internationally.

The Impact of Varying Healthcare Systems and Regulations

In different countries, healthcare systems and regulations can vary significantly

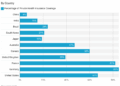

- Healthcare Costs: The cost of healthcare services and insurance premiums can vary widely from country to country. Small businesses need to consider these costs when selecting a health insurance plan that offers global coverage.

- Regulatory Compliance: Different countries have different regulations governing healthcare and health insurance. Small businesses must ensure that their health insurance plans comply with local laws and regulations to avoid any legal issues.

- Quality of Care: The quality of healthcare services can also vary globally. Small businesses should choose health insurance plans that provide access to high-quality healthcare providers in each country where their employees are based.

Navigating Cultural Differences

Cultural differences can play a significant role in how health insurance benefits are perceived and utilized by employees in different countries. Small businesses need to be sensitive to these cultural nuances when offering health insurance benefits internationally.

- Communication: Language barriers and cultural norms can impact how employees understand and use their health insurance benefits. Small businesses should provide clear and culturally appropriate communication to ensure employees are informed about their coverage.

- Healthcare Practices: Healthcare practices and beliefs can vary between cultures. Small businesses should consider these differences when designing health insurance plans to ensure they meet the unique needs of employees in different regions.

- Employee Preferences: Employee preferences for healthcare providers and treatments can differ based on cultural backgrounds. Small businesses should offer flexibility in their health insurance plans to accommodate these preferences.

Best Practices for Implementing Small Business Health Insurance

Implementing a small business health insurance plan can be a crucial step in ensuring the well-being of your employees. Here are some best practices to consider:

Steps for Selecting and Implementing a Small Business Health Insurance Plan

- Assess the needs of your employees: Understand the healthcare needs of your workforce to choose a plan that meets their requirements.

- Research different insurance providers: Compare offerings from various insurance companies to find the best fit for your business and employees.

- Consider cost and coverage: Balance the cost of premiums with the level of coverage provided to ensure your employees have access to necessary healthcare services.

- Educate employees: Communicate the details of the health insurance plan effectively to your employees to help them make informed decisions about their healthcare.

- Implement the plan: Once you have selected a plan, work with the insurance provider to set up the coverage for your employees.

Tips for Optimizing Health Insurance Plans to Attract and Retain Top Talent

- Offer additional benefits: Consider adding wellness programs or mental health support to your health insurance plan to make it more attractive to potential employees.

- Provide flexibility: Allow employees to choose from different plan options based on their individual needs to enhance satisfaction and retention.

- Seek feedback: Regularly gather feedback from employees about the health insurance plan to make improvements and ensure it meets their expectations.

Strategies for Managing Costs While Providing Comprehensive Coverage

- Consider high-deductible plans: High-deductible health plans can help lower premiums while still providing essential coverage for employees.

- Explore cost-sharing options: Implement cost-sharing arrangements between the employer and employees to mitigate expenses while maintaining quality coverage.

- Encourage preventative care: Promote wellness initiatives and preventive care services to reduce long-term healthcare costs for both the employer and employees.

Conclusive Thoughts

In conclusion, Small Business Health Insurance: Plans That Work Globally encapsulates the essence of navigating the intricate landscape of healthcare coverage for small businesses worldwide. It sheds light on the challenges, solutions, and best practices that can shape the future of health benefits for employees in a global context.

Answers to Common Questions

What are the common challenges small businesses face when providing health insurance globally?

Small businesses often struggle with navigating different healthcare systems, varying regulations, and cultural differences when offering health insurance benefits on a global scale. It can be challenging to find a plan that caters to the diverse needs of employees across different countries.

What are the advantages of offering group health insurance over individual health plans for small businesses?

Group health insurance typically offers lower premiums, broader coverage, and easier administration compared to individual health plans for small businesses. It also promotes a sense of community and support among employees.

How can small businesses optimize their health insurance plans to attract and retain top talent globally?

Small businesses can optimize their health insurance plans by offering competitive benefits, tailoring coverage to employee needs, providing wellness programs, and emphasizing the value of employee health and well-being in their recruitment efforts.