Delving into the realm of Critical Illness Cover, this article sheds light on what exactly is covered, providing insights and clarity for those seeking to understand this crucial aspect of insurance.

Exploring the nuances of coverage details, policy inclusions, claim processes, premium factors, and more, this piece aims to demystify the complexities surrounding Critical Illness Cover.

What is Critical Illness Cover?

Critical Illness Cover is a type of insurance policy that provides a lump sum payment if the policyholder is diagnosed with a critical illness that is covered by the policy.

The purpose of Critical Illness Cover is to offer financial protection to the policyholder and their family in the event of a serious illness that may prevent the individual from working or require expensive medical treatment.

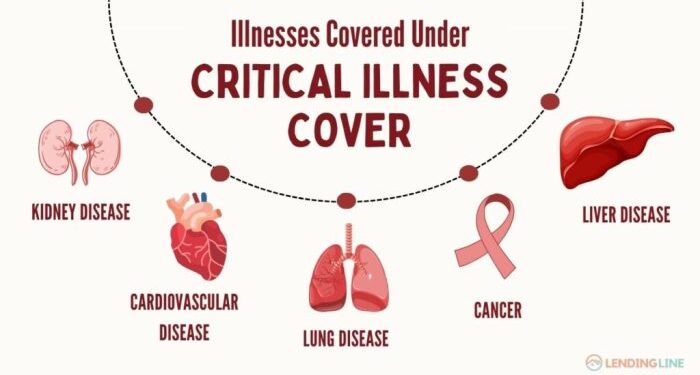

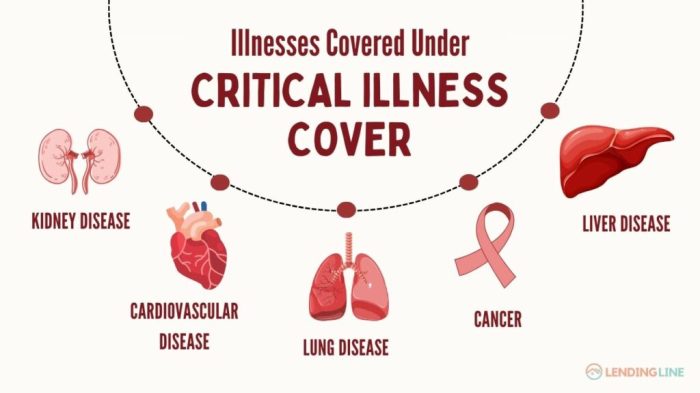

Examples of Critical Illnesses Covered

- Cancer

- Heart attack

- Stroke

- Organ transplant

- Multiple sclerosis

Coverage Details

When considering Critical Illness Cover, it is essential to understand the specific illnesses that are typically covered, as well as the exclusions and limits that may apply to your policy.Exclusions in Critical Illness Cover policies are conditions or circumstances that are not covered by the insurance.

It is crucial to review these exclusions carefully to ensure you have a clear understanding of what is and isn't covered by your policy.

Common Critical Illnesses Covered

- Cancer

- Heart Attack

- Stroke

- Organ Failure (such as kidney or liver)

- Alzheimer's Disease

Exclusions in Critical Illness Cover Policies

- Pre-existing conditions

- Self-inflicted injuries

- Drug or alcohol-related illnesses

- Illnesses not specified in the policy

- Terminal illnesses with less than 12 months to live

Importance of Understanding Coverage Limits

Understanding the coverage limits of your Critical Illness Cover policy is crucial to avoid any surprises in the event of a claim. These limits may include maximum payout amounts, restrictions on the number of claims, or specific conditions that must be met for coverage to apply.

It is essential to review and fully understand these limits to ensure you have adequate protection in place.

Policy Inclusions

When it comes to Critical Illness Cover, policy inclusions play a crucial role in enhancing the overall coverage provided. These additional benefits can vary among insurance providers, so it's essential to compare them carefully to ensure you're getting the best value for your policy.

Additional Benefits

- Waiver of Premium: Some policies may offer a waiver of premium benefit, where the policyholder is not required to pay premiums if diagnosed with a critical illness.

- Partial Payments: Certain policies provide partial payments upon diagnosis of a less severe critical illness, offering financial support even in less extreme cases.

- Recovery Support: Some insurers offer recovery support services such as counseling or rehabilitation to help policyholders cope with the aftermath of a critical illness.

- Second Medical Opinion: Policy inclusions may also cover the cost of obtaining a second medical opinion to confirm the diagnosis and explore treatment options.

Comparing Policy Inclusions

- Scope of Coverage: Different insurance providers may offer varying degrees of coverage for critical illnesses, so it's important to review the list of illnesses covered under each policy.

- Additional Services: Some policies may include additional services like access to helplines, nurse support, or wellness programs to provide comprehensive support beyond financial assistance.

- Exclusions: Understanding what is not covered by a policy is equally important. Be sure to compare exclusions to avoid any surprises when making a claim.

Significance of Policy Inclusions

Policy inclusions can significantly enhance the value of Critical Illness Cover by providing a more comprehensive safety net for policyholders. These additional benefits not only offer financial support but also contribute to the overall well-being and recovery of individuals facing critical illnesses.

By carefully comparing policy inclusions from different providers, you can select a policy that best meets your needs and offers the most extensive coverage for potential critical health challenges.

Claim Process

Claiming on a Critical Illness Cover can be a crucial step during challenging times. Understanding the process and ensuring you have all the necessary documentation in place can help make the claim process smoother and more successful.

Steps Involved in Making a Claim

- Contact your insurance provider as soon as possible to inform them of the critical illness diagnosis.

- Fill out the claim form provided by your insurance company accurately and completely.

- Gather all required medical records and reports related to the diagnosis from your healthcare provider.

- Submit the completed claim form along with the necessary documents to the insurance company for review.

- Wait for the insurer to assess your claim and provide a decision on the coverage.

- If approved, the insurer will provide the payout according to the terms of your Critical Illness Cover policy.

Tips for a Smooth and Successful Claim Process

- Notify your insurance provider promptly after diagnosis to start the claim process early.

- Double-check all information provided on the claim form to avoid delays or potential issues.

- Keep copies of all documents submitted for your records and reference.

- Follow up with the insurance company regularly to inquire about the status of your claim.

- Seek assistance from a professional or the insurance company if you encounter any difficulties during the process.

Documentation Required for Claim Submission

- Completed claim form provided by the insurance company.

- Medical reports and records confirming the critical illness diagnosis.

- Physician's statement detailing the diagnosis, treatment plan, and prognosis.

- Proof of identity and policy details for verification purposes.

- Any additional documents requested by the insurance company to support the claim.

Premium Factors

When it comes to Critical Illness Cover, the premium you pay is influenced by various factors that insurers take into consideration. Understanding what determines your premium can help you make informed decisions about your coverage.

Factors Influencing Premium Costs

- Your Age: Typically, the younger you are when you purchase Critical Illness Cover, the lower your premium will be. This is because younger individuals are generally considered lower risk.

- Health History: Your personal health history plays a significant role in determining your premium. Pre-existing conditions or a family history of certain illnesses may increase your premium.

- Lifestyle Choices: Factors such as smoking, excessive alcohol consumption, or a sedentary lifestyle can impact your premium. Insurers may charge higher premiums to individuals with riskier habits.

Impacts of Lifestyle Choices and Health History

- Smoking: Tobacco users often face higher premiums due to the increased risk of developing critical illnesses such as cancer, heart disease, and respiratory conditions.

- Healthy Lifestyle: Engaging in regular exercise, maintaining a healthy diet, and avoiding harmful habits can potentially lower your premium by reducing the risk of developing critical illnesses.

Ways to Reduce Premium Expenses

- Quit Smoking: If you are a smoker, quitting can not only improve your health but also lead to lower premium costs over time.

- Maintain a Healthy Lifestyle: Making positive lifestyle choices such as exercising regularly and eating a balanced diet can help reduce the risk of critical illnesses and potentially lower your premium.

- Compare Policies: Shopping around and comparing different Critical Illness Cover policies can help you find more affordable options without compromising on coverage.

Summary

In conclusion, Understanding Critical Illness Cover: What’s Actually Covered? serves as a comprehensive guide for individuals navigating the intricacies of insurance policies, offering valuable information to help make informed decisions about protecting against unforeseen health challenges.

Question & Answer Hub

What is Critical Illness Cover?

Critical Illness Cover is a type of insurance that provides a lump sum payment if the policyholder is diagnosed with a serious illness covered by the policy.

What are common critical illnesses covered?

Common critical illnesses covered include cancer, heart attack, stroke, and organ failure.

What factors influence the premium for Critical Illness Cover?

Factors such as age, health history, lifestyle choices, and coverage amount can influence the premium for Critical Illness Cover.